Property taxes are an essential financing base for all local governments, as they provide most of the revenue needed by schools, public safety, infrastructure, and community services.

For those living and owning property in San Mateo County, understanding property taxes and how they work will often save them from confusion and help them better plan their finances.

This blog covers the basic foundations you need to know about San Mateo County property tax, how it’s calculated, and how to pay it, plus some frequently asked questions.

What Are Property Taxes?

Property taxes are revenue instruments collected by local authorities from property owners in proportion to the assessed value of their properties. They help finance working schools, police, medical facilities, and road repair.

It is, therefore, essential to get acquainted with the state law and regulations regarding San Mateo County property tax so that you will not have any unexpected situations or ambushed circumstances.

Property taxes are not the same across all counties, and everyone must understand the laws and rates under which they fall. In San Mateo County, these taxes pay for no less than parks, libraries, or emergency services, which in turn have their effect on life standards.

How Property Taxes Are Calculated in San Mateo County

Base Property Tax Rate

According to California Proposition 13, the introductory property tax rate in San Mateo County is $1 for every $100 of the property’s assessed value. The estimated value may be the purchase price of the property plus a 2% annual increase in value due to inflation.

What is important is that property taxes have to be relatively constant and predictable, that is, constant for many years unless there is a change in ownership, extensive remodeling, or reconstruction.

Additional Levies and Assessments

Beyond the base rate, San Mateo County property tax may include additional levies such as:

School Bonds

Supporting opportunities for learning institutions within our locale so students can access quality input and learning environment.

Special Assessments

Special assessments are any costs relating to facilities that enhance communities and are helpful for particular areas, such as water and sewerage facilities.

Parcel Taxes

These are set for pre-funding of particular finite local projects, like the construction of roads or the building of facilities that improve the safety of residents.

These extras differ from one San Mateo neighborhood to another and are among the key causes of variations in the property tax rate. Citizens are advised to read the tax statement in detail to understand the unique charges made to their houses.

Annual Adjustments

Under California laws, property owners cannot be charged more than a 2% increment of what they pay annually in property taxes unless a property is sold or overhauled. The property tax is based on assessed value; the market value determines the estimated value in San Mateo.

A higher value is usually obtained in the case of a transfer of ownership or new construction, leading to an increased San Mateo property tax bill.

For instance, if you buy property for a fee of one million dollars, the initial value to be assessed will be $1 million. Expect your property tax to begin at $10,000 yearly with the 1% base rate, with further decrees and assessments.

When the property’s value rises by 2% per year, the assessed value next year will be equivalent to $1,020,000, and so forth.

How to Pay Property Taxes

Paying property taxes on time is essential to avoid penalties and other charges. Here’s how you can fulfill your obligations:

Understand Your Tax Bill

The San Mateo County property tax bills are split into two equal parts. The first is due on November 1 and is considered delinquent once December 10 arrives. The second payment is due on February 1 and is considered past due after April 10.

Your tax bill shows the base tax, additional taxes or assessments, and special assessments. You should become familiar with these details to set a relevant budget more quickly if necessary.

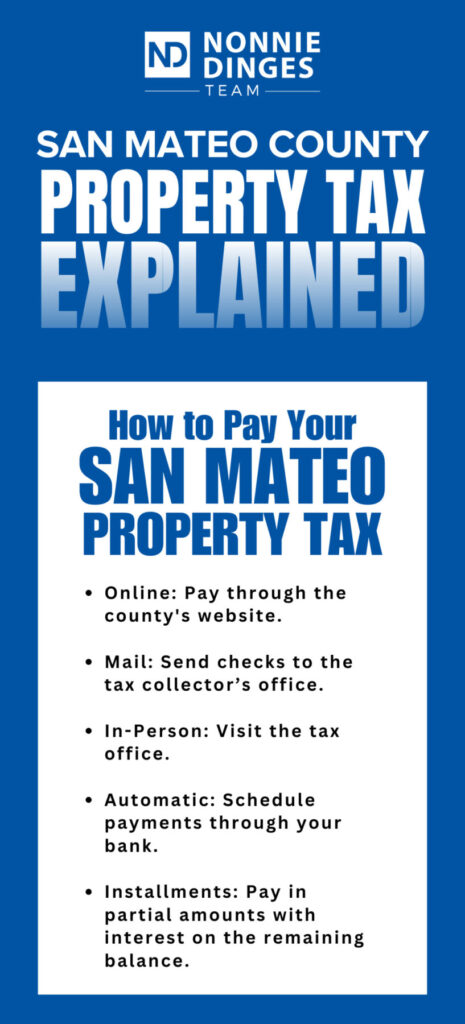

Payment Methods

Online Payments

You may pay your San Mateo County property tax online through the county’s website. This is usually the easiest and safest method adopted.

Mail Payments

For the payment, send a check or a money order to the county tax collector’s office accompanied by the payment stub. Make sure to allow adequate time for postage services.

In-Person Payments

Pay taxes directly at the county tax collector’s office. This is good for those people who engage in physical transactions.

Automatic Payments

Some banks and other financial institutions allow automatic property tax payments. The benefit of automatic payments is that they are always on time.

Partial Payments

Living in San Mateo County lets you pay in installments if you cannot pay in full. However, you will be charged interest on the balance. Their office should be contacted if they feel they cannot meet the required tax obligations.

This covers three types of programs: filing assistance programs, which provide forms and instructions for or assistance in filing tax returns; tax assistance programs, where the Internal Revenue Service or IRS directly helps a taxpayer prepare and file the tax return; and third-party tax assistance programs, or informal tax help, where any person assists the taxpayer in filing his or her returns and obtaining informal collection assistance from the IRS.

Tax Payment Assistance Programs

Some cases make programs like the Property Tax Postponement (PTP) Program helpful to some targeted individuals, like seniors and people with disabilities.

Wrap Up

Every homeowner in San Mateo County owes property tax. Knowing how it is determined, the due dates for making the payments, and your options can help you avoid penalties. Getting a regular update on taxes helps in planning our expenditures and can help the community progress.

Property owners should also seek the services of a tax consultant or accountant to formulate effective legal strategies in the area.

Please do not forget that apart from being obligatory to pay your property taxes, it is also an opportunity to contribute to the rich and diverse life of the communities in San Mateo County.

If you are interested in knowing more about San Mateo County, its lovely neighborhoods, and the availability of homes for sale, feel free to contact us at 650-218-3353 and connect with our team.

Frequently Asked Questions

What happens if I miss a payment?

In case of a missed payment, the county adds an extra 10% of the total amount to the payment that the patient failed to make on time. Furthermore, a monthly penalty of 1.5% may be charged until the contract is renewed.

Such properties can be placed for tax lien sales after some particular time. That shows why it is advisable to clear these taxes before they go past their due dates to avoid such consequences.

Are property taxes higher in San Mateo compared to other counties?

The property tax in San Mateo County is at par with that of other counties in California, but overall taxes are high due to the high property prices in this region. Other variables, like supplementary charges in levies and assessments, may also affect the figure.

San Mateo is among the wealthiest counties in California, and this dependence is often associated with such values as property rates and taxes.

What is the Property Tax Postponement Program?

California State provides a Property Tax Postponement (PTP) for senior citizens, blind people, and people with disabilities.

The program allows this category of homeowners to suspend their property taxes if they meet specific tests on income and equity in their homes. An application for the program is usually made to the California State Controller’s Office.